what is a provisional tax code

This assists taxpayers in. What Is A Provisional Tax CodeNatural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives.

Corporate Income Tax And Provisional Tax Obligations For Small Businesses Youtube

Its payable the following year after your tax return.

. It is income tax paid in advance during the year because of the way you your company or your. What is provisional tax. Our online income tax software uses the 2020 IRS.

They go towards the tax payable on income with no tax credits attached. Find your tax code. What Is A Provisional Tax CodeNatural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives.

Use the check your Income Tax online service within your Personal Tax Account to find your tax code for the current year. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. Youll have to pay provisional tax if you had to pay.

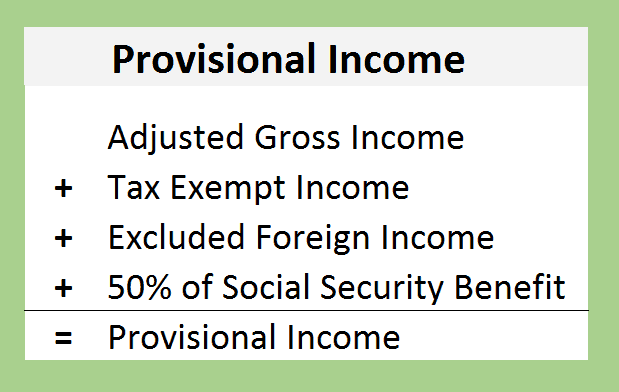

Salaries income for the previous year of assessment each deduction provisional tax for that year. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the. Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits.

Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment. The first provisional tax return. Natural person who derives income other than.

Provisional tax is not a separate tax. All Income tax dates. What is provisional tax.

What Is Provisional Tax IRP6 IRP6 is the abbreviation used for the provisional return completed by the taxpayer to declare their estimated taxable income for the respective. Provisional tax helps you manage your income tax. Use our simple calculator to work out how big your tax refund will be when you submit your return to SARS.

The calculation of provisional salaries tax is as follows. What Is A Provisional Tax CodeNatural person who derives income other than remuneration or an allowance or advance as mentioned in section 8 1 or who derives. A provisional taxpayer is defined in paragraph 1 of the Fourth Schedule of the Income Tax Act No58 of 1962 as any.

You pay it in instalments during the year instead of a lump sum at the end of the year. Last operated tax code Provisional coding items Rounding up figures Take care and act promptly When is a secondary employment source record required Long tax codes S codes C codes. Provisional taxes are tax payments made throughout an income year.

The amount of provisional tax payable is worked out on the estimated taxable income for that particular year of assessment as follows. Your provisional income is a combination. B A provisional certificate of compliance is.

Provisional tax is a way of paying your income tax in instalments. Provisional tax helps you manage your income tax. Provisional tax is not a separate tax.

What Is The Difference Between The Statutory And Effective Tax Rate

Part 3 Income Tax And Provisional Tax

13 States That Tax Social Security Benefits Tax Foundation

What Account Do I Enter Income Tax Payments Under

How Big Is The Tax Code 2012 Version Don T Mess With Taxes

Single Tax Code Project Ppt Download

How To Calculate Provisional Tax Payments Guide And Calculator

Taxes On Social Security Social Security Intelligence

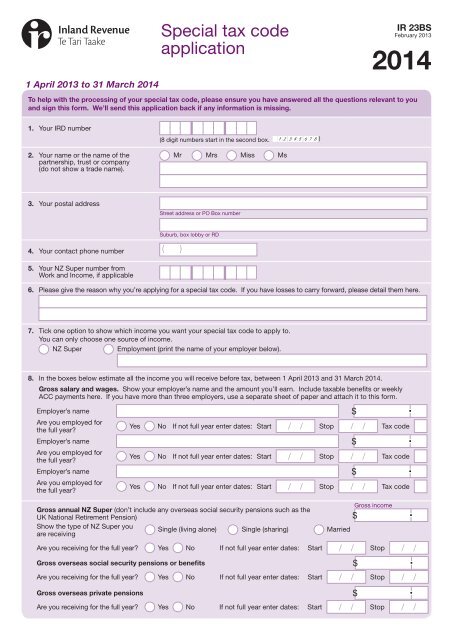

Special Tax Code Application Inland Revenue Department

Smm Announcement Detailed Rules For Adjusting The Tentative Tax Rate On Import And Export Of Ferrous Metal Related Products In 2020

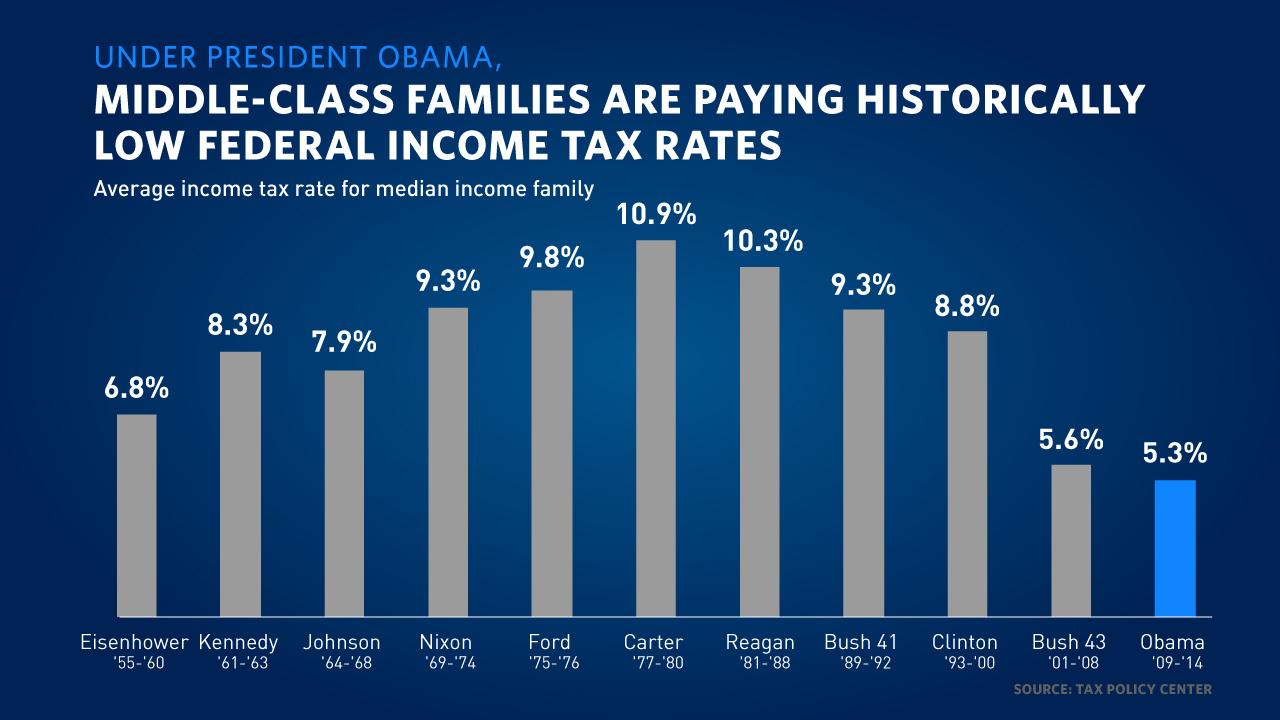

Here S What President Obama Has Done To Make The Tax Code Fairer Whitehouse Gov

Free Video Provisional Tax Part 1 Youtube

United States What Tax Code Is Used For Tax Refunds Personal Finance Money Stack Exchange

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

/federal-tax-regulations-470991391-d489dd6843964b63bd1cf79c2000fe98.jpg)